|

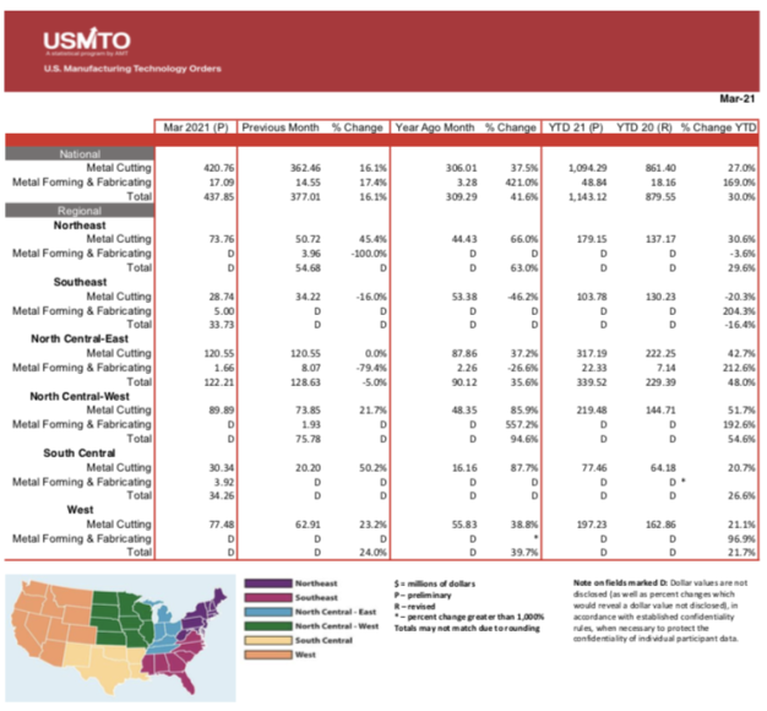

U.S. Manufacturing Technology Orders totaled $437.9 million, an increase of 16.1% over February 2021 and an increase of 41.6% over March 2020, according to the latest U.S. Manufacturing Technology Orders report published by AMT... by Kristin Bartschi May 10, 2021 Read the Full Press Release report below

0 Comments

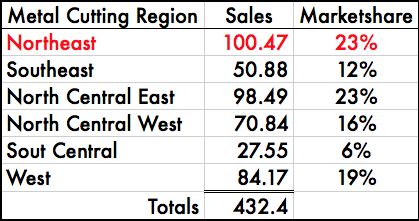

McLean, Va. (April 8, 2019) – Manufacturing technology orders totaled $337.2 million in February 2019 accounting for a 15 percent decline from January and a seven percent decline from the previous February, according to the latest USMTO report from AMT. The year-to-date total was $735.2 million, less than one percent off the year-to-date total at this point last year.

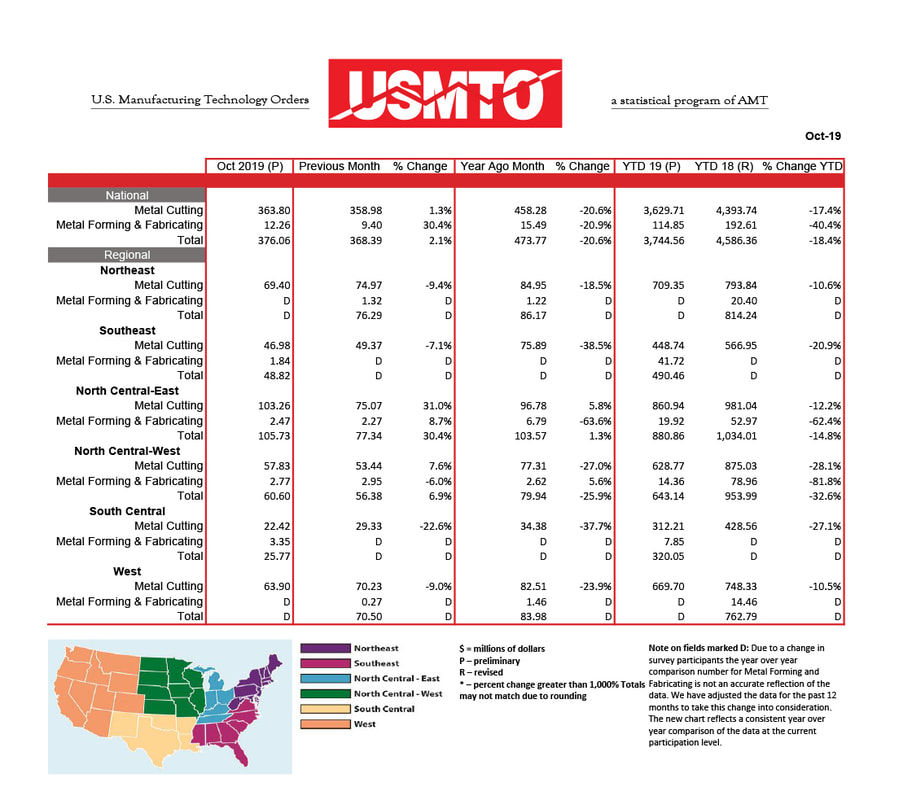

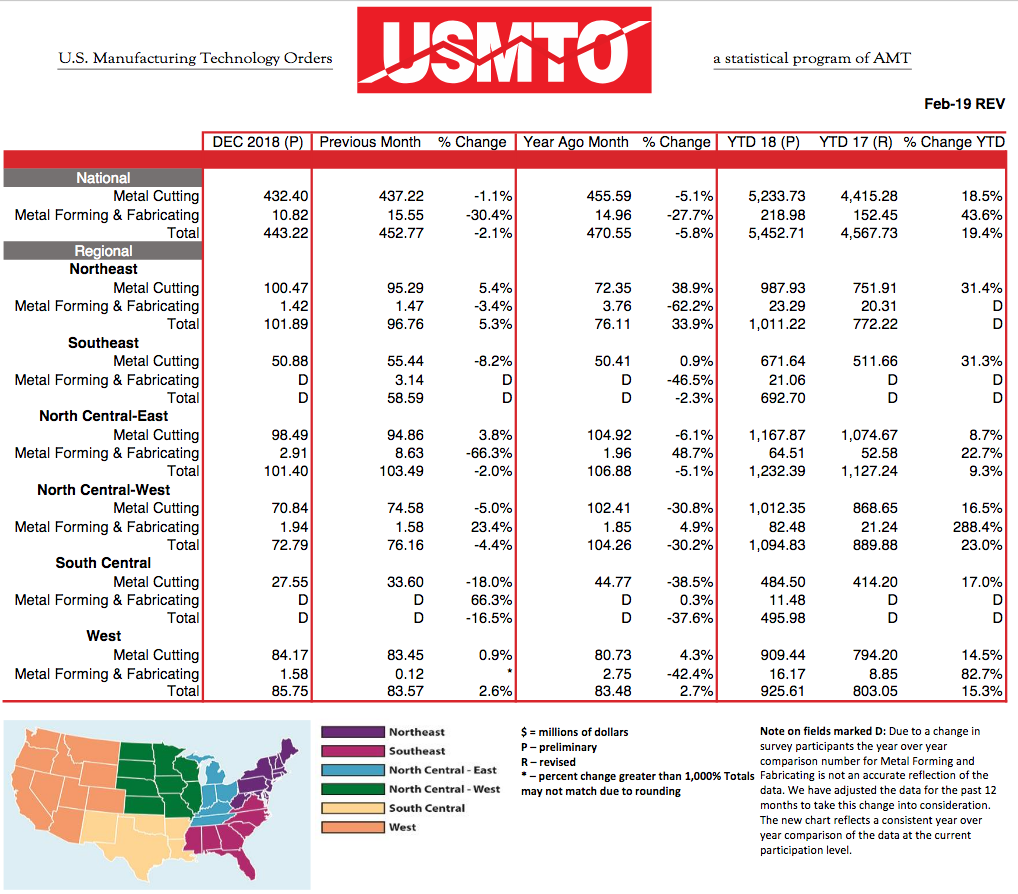

“It’s important to look at the February numbers in context. It’s true that order levels declined, but from the second strongest January in the history of the USMTO program. They’re still at good levels compared to this time a year ago,” said Douglas K. Woods, President, AMT. “Other indicators signal continued manufacturing strength. AMT members are generally positive heading into the second quarter; the U.S.-China tariff negotiations look to be moving toward a successful conclusion; and the March ISM Manufacturing PMI showed expansion which beat analysts’ expectations and rallied the stock market. However, uncertainty lingers on issues such as tax, trade and the budget, and continued inaction in Washington could stall already sluggish growth.” While companies in many industries reduced their orders in February, the nearly 50 percent decline in orders placed by the Aerospace as well as Engine and Turbine industries led the downturn between January and February. The Automotive sector recorded a modest double-digit uptick. Bucking the general trend, February 2019 had a notable expansion in orders from Commercial and Service Industry Machinery Manufacturing such as Water Treatment and Commercial Cleaning Equipment. The big gain was the result of large orders in the Great Lakes area and the West. Four of the six USMTO regions had fewer orders in February than January, with the largest decline coming from the Southeast. In the West, metal cutting orders rose slightly. However, declines in Forming and Fabricating lead to roughly stagnant orders compared to the previous month. The South Central region outperformed all other regions, with orders expanding by over a third from January 2019 led by growth in Oil & Gas, Contract Machining, and Food Processing Equipment sectors. Capacity utilization had a second month of declines in February, settling at 77 percent, off the post-recession high of 77.8 percent in December 2018. Despite an increase in orders from the Automotive Sector, Light Vehicle Sales rebounded to 17.477 million annualized units in March. March Manufacturing ISM® Report On Business® registered a Purchasing Manager’s Index of 55.3 percent, an expansion of 1.1 percentage points over February, signaling underlying strength in the manufacturing sector. Gains Shared by Small, Medium, and Large Job Shops MCLEAN, Va. (December 9, 2019) U.S. manufacturing technology orders totaled $376 million in October 2019 according to the latest U.S. Manufacturing Technology Orders (USMTO) Report published by AMT – The Association For Manufacturing Technology. October orders increased 2 percent over September 2019. New orders placed in October 2019 fell 21 percent from October 2018, which was one of the best Octobers in USMTO history. Despite month over month gains, the gap between the year-to-date totals grew larger with the addition of October data. Orders placed to date in 2019 totaled $3.75 billion, a decrease of 18.4 percent from the annual total through October 2018. The industrial machinery manufacturing sector experienced robust growth in October 2019. Orders from machine shops grew at a modest pace but have not returned to their later-summer levels. The automotive sector increased orders by about 40 percent in October, while the aerospace sector decreased orders by slightly over ten percent. “Since March, job shops have accounted for an unusually large share of orders, reflecting the fact that large players deflected capital spending decisions to their sub-tier supply chain,” said Douglas K. Woods, president of The Association For Manufacturing Technology. That trend began a reversal in October, however, as companies of all sizes placed orders. Our research and the data point to a shifting of capital investment activity from small companies downstream to tier two and one suppliers. Based on quotations activity, orders in November and December are likely to be from larger companies expiring their capital spending budgets rather than small manufacturers continuing to invest at their second and third quarter rates.” “It’s clear that a lack of stability in the market coupled with the shifting winds on trade issues are dampening U.S. manufacturers’ enthusiasm for investing in new capital equipment. At the same time, we are nearly half way through the Tax Reform’s five-year window of providing lower tax rates and investment incentives. The former creates instability, and while the latter should be creating an urgency to invest, our analysts and leading industry economists believe that the confluence of drivers will yield a positive impact on the market in late 2020 and throughout 2021.” You may not be familiar with U.S. Manufacturing Technology Order Report, also referred to as the "USMTO Report" but you should check it out. It's basically a monthly scorecard of how our metalcutting industry is doing on a monthly basis.  The February report was recently released and has some interesting data that you can find below. What we wanted to share with you is some data that you may not realize. If you take closer look at the maps and number belows, you'll see that the market area the F&L Technical Sales manages for our principals is nearly 23% of the entire US Market. Metalcutting manufacturing has certainly grown in the past two decades since we started F&L Technical Sales, Inc adn we would like to think that we've helped in the regions competitiveness and growth. Modest fall in December Orders Offset by19% Gain in Annual Total over 2017 For Immediate Release: February 11, 2019 Contact: Amber Thomas Director - Advocacy & Communications, AMT 571-216-7448 or athomas@AMTonline.org McLean, Va., (February 11, 2019) - U.S, manufacturing technology orders posted $443 million in December, down two percent from November and six percent from December 2017. The year-end order total for 2018 was $5.5 billion, up 19 percent from the annual sum for 2017. The November to December drop was only the fourth time in the program’s 23-year history that a year didn’t end with an uptick in orders from November. “We finished a fantastic run up in manufacturing technology orders during 2018, with most analysts looking for good growth in units and modest growth in revenue in 2019,” said AMT President Doug Woods. “While our market looks healthy now, there are concerns that trade issues and slower manufacturing technology markets abroad will create headwinds in the U.S. later in the year.” December orders fell by a modest amount which negatively impacted most industries. Aerospace and Engines and Turbines placed a third or more orders than in November. The Forging and Stamping industry had a very good second half of 2018 posting month-on-month increases in orders for the last three months. Surprisingly, Government and Defense orders were also up in December, perhaps in anticipation of a prolonged government shutdown evenly spread across almost all industrial sectors. Geographically, the Northeast and West were the strongest markets in December, each posting single-digit gains over November levels. Aerospace and Engines and Turbines held up marketlevels in what would have been a lackluster month for the Northeast region otherwise. The West held on to a gain in December thanks to the Auto and Stamping and Forging industries. The Northcentral East continues to generate the most orders, but its share has dropped significantly in the past three years. The Northcentral West is the second largest region by dollar volume followed by the Northeast. If you would like to read the entire report you can see it below. You can also check out the USMTO website each month for updates.

|

ABOUT

This is where we publish technical articles, applications stories, tip and tricks, new product announcements and press releases. Archive

March 2024

Categories

All

|

|

F&L Technical Sales Inc.

326 Woodland Way Russell, MA 01071 Established 1999

|

© 2024 F&L Technical Sales Inc.

All Rights Reserved site design: Rapid Production Marketing

|

RSS Feed

RSS Feed